SurFIN®: Foreign Remittance Processing Workflow Solution

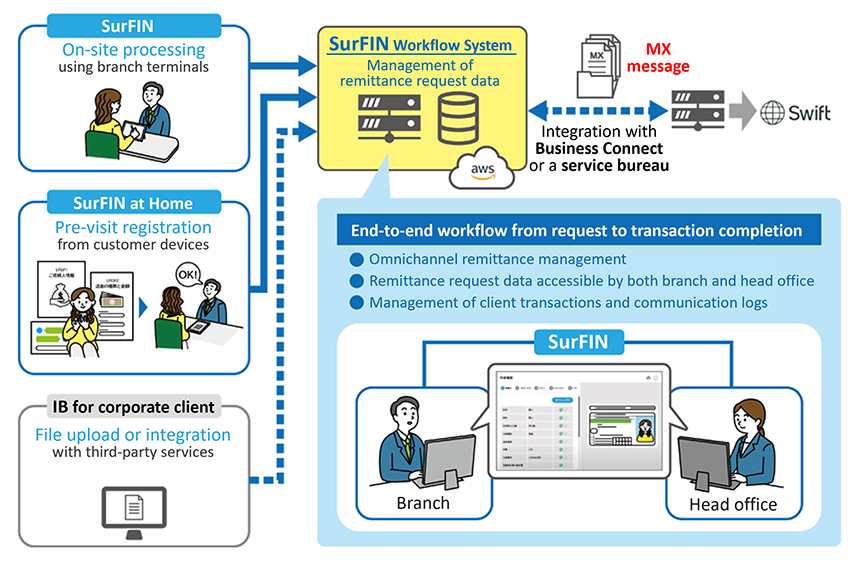

SurFIN is a smart workflow solution designed for financial institutions, simplifying the entire foreign remittance journey—from initial customer request to final transaction—through automated MX message generation.

The system reduces administrative burden, especially for anti-money laundering (AML) checks, by managing all remittance data digitally. It can be seamlessly integrated with core banking systems to enable precise control over debit and credit instructions.

An optional service called “Ouchide-SurFIN" (Home-Use SurFIN), allows customers to submit remittance requests and schedule visits to the branch from their personal devices. This enables faster in-branch processing and significantly reduces workload for branch staff. It replaces handwritten forms with a browser-based interface, allowing customers to input remittance details directly and enabling efficient digital processing.

Streamlining cross-border payment operations with "ISO20022-compliant SurFIN".(2:46)

Overview

SurFIN is an all-in-one workflow solution that streamlines foreign remittance operations by combining customer input, back-office processing, and Swift connectivity in a single platform.

We also offer a feature that enables importing remittance data from a corporate internet banking service specialized in foreign remittance, allowing integrated management of both in-person and online remittance operations.

In addition, BIPROGY has the Swift Complementor Certification. With Business Connect, we provide a one-stop service from receiving remittance requests to transmitting messages.

-

For Remittance Requestors

-

Web Input Form:

Easy-to-use form with clear remittance entry fields.

-

Multilingual Support:

Supports interface in English, Chinese, and other languages.

-

Document Upload:

Upload personal identification and supporting documents.

-

-

For Financial Institutions

-

Status Management:

Track both outgoing and incoming remittance status for each transaction.

-

Digital Recordkeeping:

Store remittance data and documents digitally in SurFIN.

-

-

Ouchide-SurFIN (Home-Use SurFIN) *Optional Service

-

Web Input Form:

Enter remittance details from home via smartphone or PC.

-

Branch Visit Reservation:

Select branch and date for in-person identity verification.

-

Document Capture:

Capture and upload ID documents via smartphone camera.

-

Benefits

-

Reducing Workload at Bank Branches

-

Eliminates handwriting errors and manual corrections.

-

A user-friendly interface minimizes the need for staff assistance during data entry.

-

Multilingual support helps diverse language-speaking customers.

-

-

Consistent Foreign Remittance Operations Regardless of Staff Experience

-

Easily check required items and record customer interactions.

-

View processing status per case with status management.

-

Store requests and documents directly in the SurFIN system.

-

-

Enhanced AML Compliance

-

Search transactions and download documents for AML reporting.

-

-

Strengthened Non-Face-to-Face Channels

-

Apply for remittance and schedule branch visits via PC or smartphone.

-

Share application data and manage workflow across departments.

-

Topics

-

December, 02, 2025

-

Oct, 30, 2025

-

September, 05, 2025

Exhibition at Sibos Frankfurt

~Sharing SurFIN’s Benefits and Expansion Strategy with the World~

*SurFIN is a registered trademark of BIPROGY Inc.

*All other company names and product names mentioned are trademarks or registered trademarks of their respective owners.